Market Update: February 2025 Housing Market Recap

February 2025 brought a mix of stabilization and subtle shifts to the housing market, offering a clearer picture of where things might be headed after a volatile few months. Let’s break down the key trends since late 2024 and what they mean for buyers and sellers.

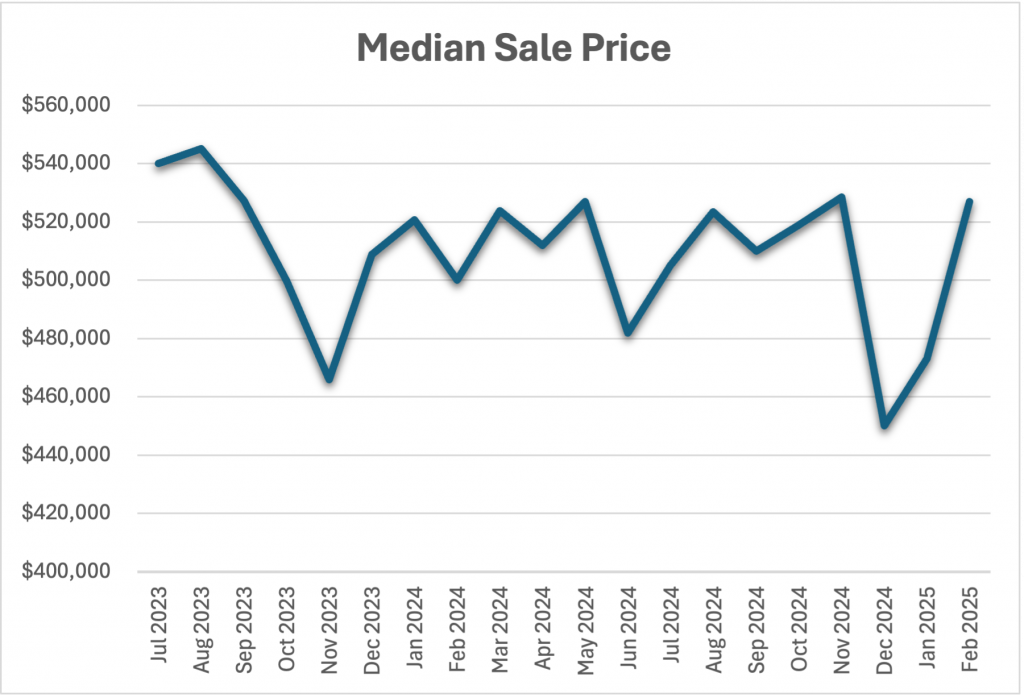

- Median Sale Price: In February, the median sale price climbed to $527,000, an 11.4% increase from January’s $473,000. This marks a notable rebound after a steep 14.9% drop from December 2024’s $556,000 to January. The sharp decline at the end of 2024 likely reflected seasonal slowdowns or buyer hesitation—possibly tied to economic uncertainty or interest rate fluctuations—but February’s uptick suggests demand is starting to firm up. Prices are now back in line with October 2024 levels ($528,500), indicating a potential stabilization after a rocky few months. For context, this $527,000 is 5.4% higher than February 2024’s $500,000, showing modest annual growth despite recent volatility.

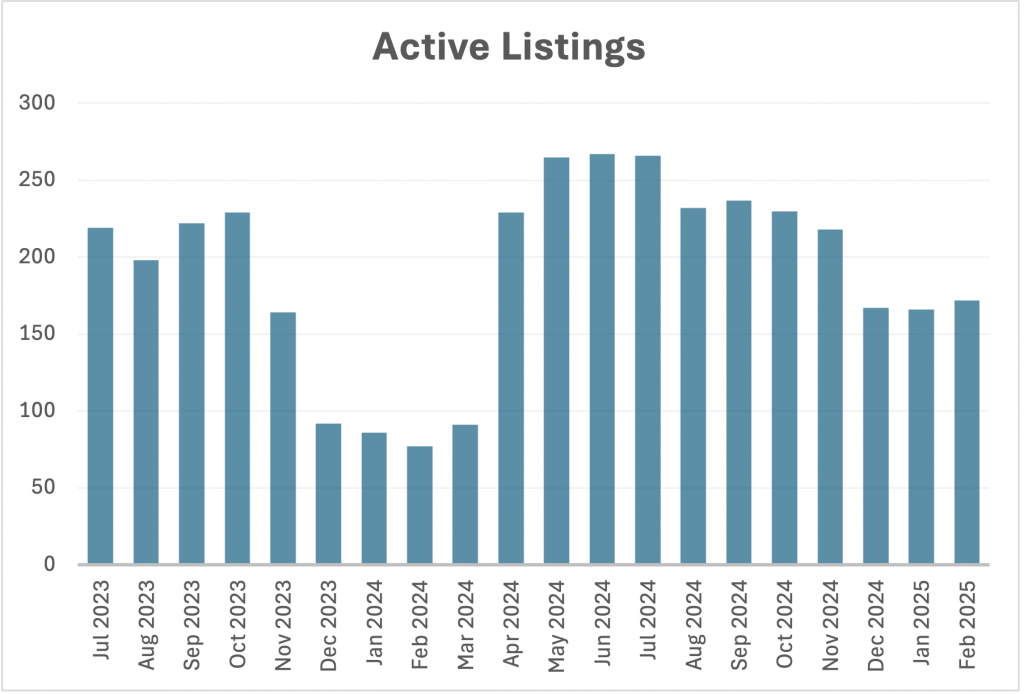

- Active Listings: Inventory edged up to 172 listings in February, a 3.6% increase from January’s 166, and a continuation of a gradual upward trend since December 2024’s low of 167. This slow but steady rise in available homes—up from 167 in December to 172 in February—suggests sellers are cautiously re-entering the market, perhaps encouraged by the price recovery. More listings mean buyers have a bit more breathing room, which could temper price growth if this trend continues into the spring.

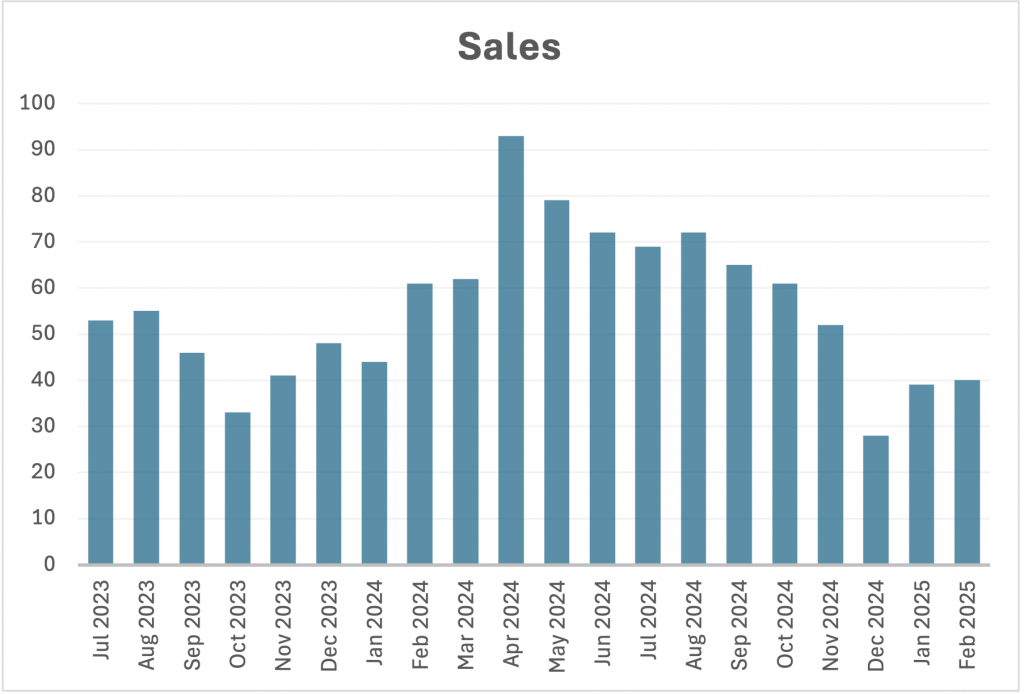

- Sales: Sales ticked up slightly to 40 in February, a 2.6% increase from January’s 39, but this follows a significant 46.2% drop in December from November 2024’s 52 sales. The sharp decline at the end of 2024 likely reflected a seasonal dip, but the modest recovery in February hints at renewed buyer interest, possibly driven by the price correction in January making homes more attractive. However, sales remain well below the 65-72 range seen in the summer and early fall of 2024, suggesting that while the market is stabilizing, buyer confidence hasn’t fully returned.

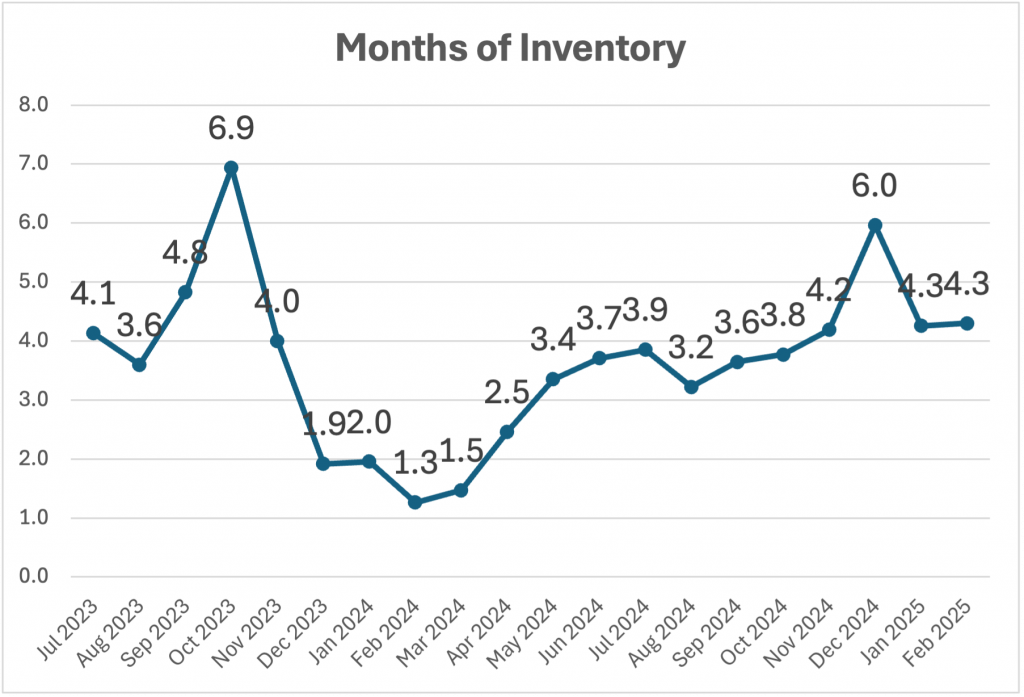

- Months of Inventory: Inventory levels held steady at 4.3 months in February, unchanged from January. This gradual increase over the past few months reflects the combination of rising listings and slower sales. A 4.3-month supply is a balanced market—neither a seller’s nor a buyer’s market—but the trend toward higher inventory could start to tilt the scales in favour of buyers if sales don’t pick up more significantly in the coming months.

- Sale-to-Price Ratio: The sale-to-price ratio remained at 98% for the third consecutive month, a consistent trend since December 2024. This stability is telling: even as prices fluctuated and inventory grew, sellers have held firm on their asking prices, and buyers are still willing to meet them. It suggests a market where both sides are finding common ground, but if inventory continues to rise without a corresponding increase in sales, we might start to see more negotiating power shift to buyers.

- Days on Market: Homes sold faster in February, with the average days on market dropping to 47 from January’s 54—a notable improvement after a steady rise from October 2024’s 36 days. This acceleration suggests that the price rebound in February may have drawn buyers back into the market, or that the homes listed were better aligned with buyer preferences. However, 47 days is still longer than the 29-38 days we saw through much of mid-2024, indicating that while the market is warming slightly, it’s not as brisk as it was last spring or summer.

What This Means Moving Forward

The past few months reveal a market in transition. The sharp price drop in December—followed by a quick recovery in February—suggests we may have hit a bottom, at least temporarily. Buyers who hesitated at the end of 2024 seem to be dipping their toes back in, encouraged by more listings and slightly faster sales. But the steady rise in inventory and the fact that sales haven’t returned to mid-2024 levels tell us that the market isn’t out of the woods yet. If listings continue to grow without a proportional increase in demand, we could see downward pressure on prices by late spring. On the flip side, if buyer confidence strengthens—perhaps due to stabilizing interest rates or improved economic conditions—the price recovery we saw in February could gain momentum.

For sellers, the consistent 98% sale-to-price ratio is a green light to list now, especially if you’re in a position to price competitively and move quickly. For buyers, the growing inventory and balanced market mean you have more options and less pressure to rush, but don’t expect deep discounts just yet—sellers are still holding firm. As we head into March, keep an eye on sales volume and days on market; they’ll be the best indicators of whether this stabilization turns into a broader recovery.